Free AI-Powered CBOE 5 Year Treasury Note Yield Index (FVX) Trading Signals | CBOE 5 Year Treasury Note Yield Index (FVX) Price Forecast

AI-Powered CBOE 5 Year Treasury Note Yield Index (FVX) Signals and Analysis for Nov 27th

By aggregating insights from multiple AI models, each with an accuracy rate of at least 70%, we recommend considering the purchase of CBOE 5 Year Treasury Note Yield Index (FVX) on Nov 27. Nevertheless, always exercise caution when making investment decisions. A thoughtful and careful approach to investments is essential.

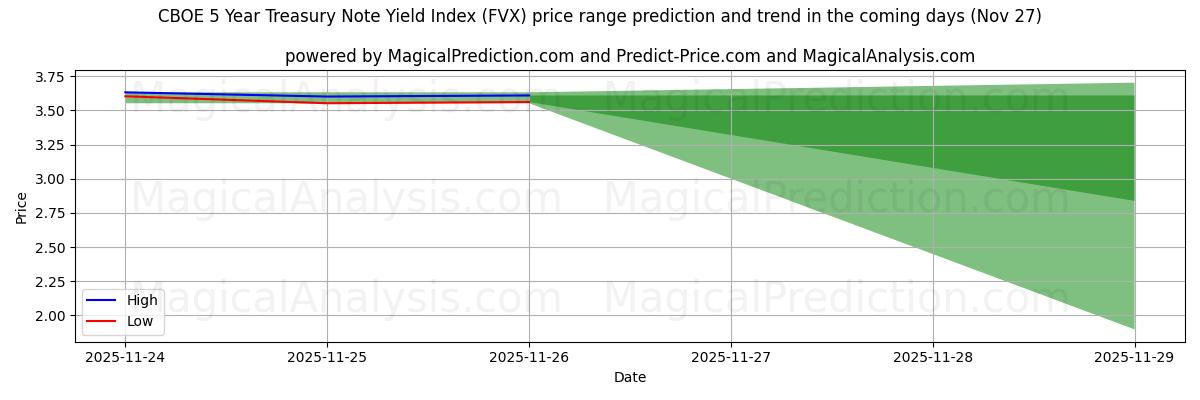

On Nov 27, our AI models forecast a price range for CBOE 5 Year Treasury Note Yield Index (FVX) with a minimum estimate of 1.898 and a maximum estimate of 3.704.

Disclaimer! Please exercise caution and perform thorough due diligence before making any financial decisions. Our signals are based solely on daily price fluctuations and do not account for external factors such as news, market sentiment, or company-specific developments. We strongly advise considering all relevant factors and conducting your own research.

Useful Tips: To enhance your decision-making regarding CBOE 5 Year Treasury Note Yield Index (FVX) investments, we highly recommend visiting the "MagicalAnalysis" technical analysis website. They offer free signals as well, and if a signal aligns with ours, it is likely to be a reliable and valid indicator, as our historical data suggests.

Based on the signals and forecasts provided, we recommend the following strategies:

CBOE 5 Year Treasury Note Yield Index (FVX) trading strategy for those currently in buy positions (long positions):

If you are in a buy position (long position), holding onto your position may be advisable according to the consensus of our AI models. However, always remain vigilant and monitor market developments closely.

CBOE 5 Year Treasury Note Yield Index (FVX) trading strategy for those currently in sell positions (short positions):

If you are in a sell position (short position), it is recommended to determine the optimal time to exit based on the combination of AI models' insights. If you have a high risk tolerance, you might choose to wait for further market movements in the coming days.

For new positions:

If you are not currently in the market or considering entering a buy position (long position), consider the projected price range. This range represents a potential upside of 3.69%, based on the highest predicted price. However, prior to initiating a buy position, ensure it aligns with your risk tolerance and investment goals through thorough research.

In all your trading endeavors, implementing a well-defined stop-loss strategy is crucial for managing potential downside risks effectively.

Useful Tips 2: For long-term forecasting, we suggest utilizing the "predict-price" website, which offers both short-term and long-term predictions for free. This can assist in making well-informed decisions regarding your CBOE 5 Year Treasury Note Yield Index (FVX) investments.

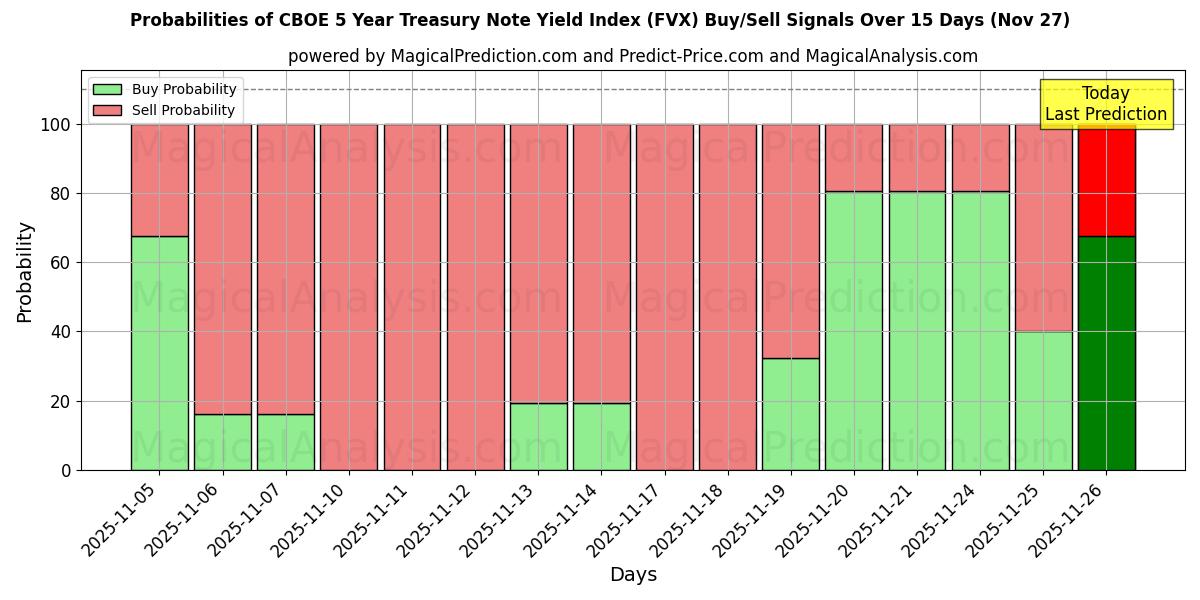

Probabilities of CBOE 5 Year Treasury Note Yield Index (FVX) Buy/Sell Signals Using Several AI Models Over 10 Days (Nov 27)

CBOE 5 Year Treasury Note Yield Index (FVX) AI's overall Signal Chart (27 Nov)

CBOE 5 Year Treasury Note Yield Index (FVX) AI best signal chart (27 Nov)

High and low price prediction by AI for CBOE 5 Year Treasury Note Yield Index (FVX) (27 Nov)

CBOE 5 Year Treasury Note Yield Index (FVX) profit and loss prediction for 27 Nov

CBOE 5 Year Treasury Note Yield Index (FVX) signals list for 27 Nov

| # | AI Model | Last signal | Accuracy |

|---|---|---|---|

| 1 | Model1 | Sell | 62.19% |

| 2 | Model2 | Sell | 46.19% |

| 3 | Model3 | Sell | 64.18% |

| 4 | Model4 | Sell | 45.61% |

| 5 | Model5 | Sell | 62.19% |

| 6 | Model6 | Sell | 45.29% |

| 7 | Model7 | Neutral | 46.62% |

| 8 | Model8 | Neutral | 62.75% |

| 9 | Model9 | Sell | 61.3% |

| 10 | Model10 | Sell | 49.73% |

| 11 | Model11 | Sell | 55.98% |

| 12 | Model12 | Sell | 66.64% |

| 13 | Model13 | Sell | 64.88% |

| 14 | Model14 | Sell | 64.87% |

| 15 | Model15 | Buy | 51.54% |

| 16 | Model16 | Sell | 61.28% |

| 17 | Model17 | Sell | 57.78% |

| 18 | Model18 | Buy | 51.55% |

| 19 | Model19 | Sell | 52.42% |

| 20 | Model20 | Buy | 51.26% |

| 21 | Model21 | Buy | 53.32% |

| 22 | Model22 | Buy | 69.33% |

| 23 | Model23 | Buy | 55.97% |

| 24 | Model24 | Buy | 70.31% |

| 25 | Model25 | Buy | 53.32% |

| 26 | Model26 | Buy | 70.22% |

| 27 | Model27 | Neutral | 64.58% |

| 28 | Model28 | Neutral | 56.51% |

| 29 | Model29 | Buy | 54.21% |

| 30 | Model30 | Buy | 65.78% |

| 31 | Model31 | Buy | 59.53% |

| 32 | Model32 | Buy | 48.87% |

| 33 | Model33 | Buy | 50.63% |

| 34 | Model34 | Buy | 50.64% |

| 35 | Model35 | Sell | 63.97% |

| 36 | Model36 | Buy | 56.08% |

| 37 | Model37 | Buy | 57.73% |

| 38 | Model38 | Sell | 63.96% |

| 39 | Model39 | Buy | 63.09% |

| 40 | Model40 | Sell | 65.89% |

| 41 | Model41 | Buy | 56.6% |

| 42 | Model42 | Buy | 57.1% |

| 43 | Model43 | Buy | 56.59% |

| 44 | Model44 | Neutral | 46.62% |

| 45 | Model45 | Neutral | 58.58% |

| 46 | Model46 | Neutral | 62.76% |

| 47 | Model47 | Sell | 49.4% |

| 48 | Model48 | Sell | 58.78% |

| 49 | Model49 | Sell | 63.31% |

| 50 | Model50 | Sell | 57.9% |

| 51 | Model51 | Sell | 59.33% |

| 52 | Model52 | Sell | 58.04% |

| 53 | Model53 | Sell | 58.42% |

| 54 | Model54 | Neutral | 64.61% |

| 55 | Model55 | Neutral | 58.61% |

| 56 | Model56 | Neutral | 53.82% |

| 57 | Model57 | Buy | 62.17% |

| 58 | Model58 | Buy | 57% |

| 59 | Model59 | Buy | 52.47% |

| 60 | Model60 | Buy | 57.88% |

| # | Overall | Buy | -- |

| # | Best | Buy | 70.31% |

CBOE 5 Year Treasury Note Yield Index (FVX) predictions list over the past days

| # | Overal Signal | Best Signal | Signals of artificial intelligence models | Stop Loss | |

|---|---|---|---|---|---|

| 1 | 26 Nov | Buy | Buy | M12 M22 M24 M26 M30 M40 | 3.562000 |

| 2 | 25 Nov | Sell | Neutral | M12 M22 M24 M26 M30 M40 | 3.602000 |

| 3 | 24 Nov | Buy | Buy | M12 M22 M24 M26 M30 M40 | 3.604000 |

| 4 | 21 Nov | Buy | Buy | M12 M22 M24 M26 M30 M40 | 3.609000 |

| 5 | 20 Nov | Buy | Buy | M12 M22 M24 M26 M30 M40 | 3.649000 |

| 6 | 19 Nov | Sell | Sell | M12 M22 M24 M26 M30 M40 | 3.712000 |

| 7 | 18 Nov | Sell | Sell | M12 M22 M24 M26 M30 M40 | 3.714000 |

| 8 | 17 Nov | Sell | Sell | M12 M22 M24 M26 M30 M40 | 3.731000 |

| 9 | 14 Nov | Sell | Sell | M12 M22 M24 M26 M30 M40 | 3.735000 |

| 10 | 13 Nov | Sell | Sell | M12 M22 M24 M26 M30 M40 | 3.713000 |

Users forecasts for CBOE 5 Year Treasury Note Yield Index (FVX)

What is your prediction?

In this section, you can easily predict without user registration. See also other users predictions.