Free AI-Powered DAXSECTOR INSURANCE TR (CXPIX) Trading Signals | DAXSECTOR INSURANCE TR (CXPIX) Price Forecast

AI-Powered DAXSECTOR INSURANCE TR (CXPIX) Signals and Analysis for Jan 08th

Combining predictions from multiple artificial intelligence models, each with an accuracy rate of at least 70%, also yielded no discernible signals for DAXSECTOR INSURANCE TR (CXPIX) on Jan 08. Therefore, exercising caution in making investment decisions is strongly advised.

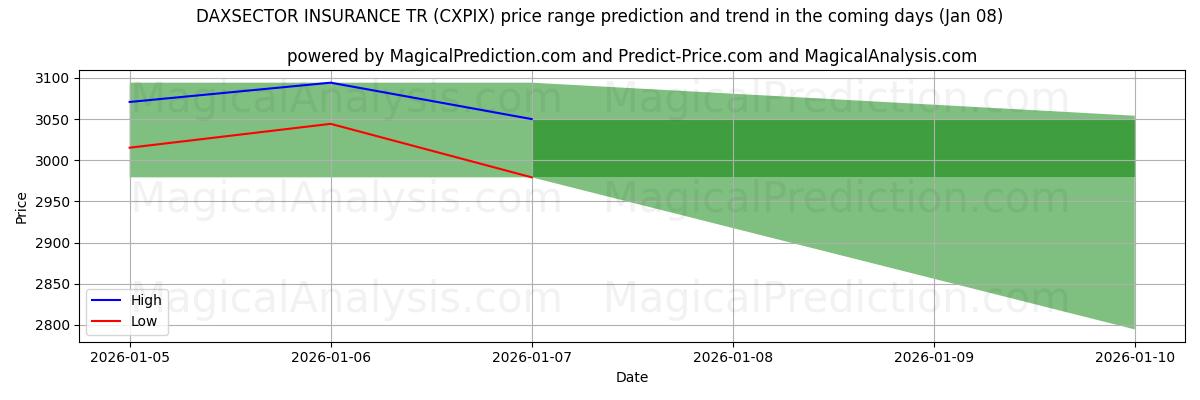

On Jan 08, our AI models predicted a price range for DAXSECTOR INSURANCE TR (CXPIX), with a minimum estimate of 2794.445 and a maximum estimate of 3054.043.

Disclaimer! Please exercise caution and thorough consideration before making any financial decisions. Our signals are based solely on daily price changes and do not account for external factors such as news, market sentiment, or company developments. We strongly recommend considering all relevant factors and conducting your own research.

Useful Tips: To make the most informed decisions about your DAXSECTOR INSURANCE TR (CXPIX) investments, we recommend visiting the "MagicalAnalysis" technical analysis website. They also provide signals for free, and if a signal aligns with ours, it's likely to be a reliable and valid indicator, as we’ve observed over time.

According to the above signals and forecasts, we recommend the following strategies:

DAXSECTOR INSURANCE TR (CXPIX) trading strategy for those in buy positions (long positions):

If you are currently in a buy position, it is advisable to wait for the next few days to see if the position stabilizes or changes, due to the absence of a definitive signal.

DAXSECTOR INSURANCE TR (CXPIX) trading strategy for those in sell positions (short positions):

If you are currently in a sell position (short position), it is advisable to wait for the next few days to see if the position stabilizes or changes, due to the absence of a definitive signal.

For new positions:

If you have not yet invested, it is recommended to wait for the next few days before making any decisions, due to the absence of a definitive signal.

Useful Tips 2: For those interested in long-term forecasting, we suggest utilizing the "predict-price" website, which offers both short-term and long-term predictions for free. This can help you make well-informed decisions about your DAXSECTOR INSURANCE TR (CXPIX) holdings.

Probabilities of DAXSECTOR INSURANCE TR (CXPIX) Buy/Sell Signals Using Several AI Models Over 10 Days (Jan 08)

DAXSECTOR INSURANCE TR (CXPIX) AI's overall Signal Chart (08 Jan)

DAXSECTOR INSURANCE TR (CXPIX) AI best signal chart (08 Jan)

High and low price prediction by AI for DAXSECTOR INSURANCE TR (CXPIX) (08 Jan)

DAXSECTOR INSURANCE TR (CXPIX) profit and loss prediction for 08 Jan

DAXSECTOR INSURANCE TR (CXPIX) signals list for 08 Jan

| # | AI Model | Last signal | Accuracy |

|---|---|---|---|

| 1 | Model1 | Sell | 57.23% |

| 2 | Model2 | Buy | 55.63% |

| 3 | Model3 | Neutral | 58.27% |

| 4 | Model4 | Buy | 56.47% |

| 5 | Model5 | Sell | 57.23% |

| 6 | Model6 | Buy | 56.42% |

| 7 | Model7 | Neutral | 56.16% |

| 8 | Model8 | Neutral | 52.77% |

| 9 | Model9 | Sell | 58% |

| 10 | Model10 | Buy | 52.51% |

| 11 | Model11 | Sell | 61.18% |

| 12 | Model12 | Sell | 62.73% |

| 13 | Model13 | Sell | 63.51% |

| 14 | Model14 | Sell | 61.16% |

| 15 | Model15 | Buy | 54.09% |

| 16 | Model16 | Sell | 56.86% |

| 17 | Model17 | Sell | 62.73% |

| 18 | Model18 | Buy | 58.78% |

| 19 | Model19 | Buy | 55.67% |

| 20 | Model20 | Buy | 55.49% |

| 21 | Model21 | Buy | 60.37% |

| 22 | Model22 | Sell | 61.97% |

| 23 | Model23 | Neutral | 58.24% |

| 24 | Model24 | Sell | 62.43% |

| 25 | Model25 | Buy | 60.37% |

| 26 | Model26 | Sell | 61.18% |

| 27 | Model27 | Neutral | 56.2% |

| 28 | Model28 | Neutral | 52.79% |

| 29 | Model29 | Buy | 59.6% |

| 30 | Model30 | Sell | 65.09% |

| 31 | Model31 | Buy | 56.42% |

| 32 | Model32 | Buy | 54.87% |

| 33 | Model33 | Buy | 54.09% |

| 34 | Model34 | Buy | 56.44% |

| 35 | Model35 | Sell | 63.51% |

| 36 | Model36 | Buy | 55.59% |

| 37 | Model37 | Buy | 54.87% |

| 38 | Model38 | Sell | 58.82% |

| 39 | Model39 | Sell | 61.93% |

| 40 | Model40 | Sell | 61.93% |

| 41 | Model41 | Buy | 55.75% |

| 42 | Model42 | Buy | 55.39% |

| 43 | Model43 | Buy | 54.22% |

| 44 | Model44 | Neutral | 45.16% |

| 45 | Model45 | Neutral | 47.01% |

| 46 | Model46 | Neutral | 54.57% |

| 47 | Model47 | Neutral | 53.14% |

| 48 | Model48 | Sell | 49.76% |

| 49 | Model49 | Sell | 55.83% |

| 50 | Model50 | Sell | 58.93% |

| 51 | Model51 | Sell | 61.32% |

| 52 | Model52 | Sell | 61.82% |

| 53 | Model53 | Sell | 63.94% |

| 54 | Model54 | Neutral | 72.75% |

| 55 | Model55 | Neutral | 70.56% |

| 56 | Model56 | Neutral | 69.35% |

| 57 | Model57 | Neutral | 61.4% |

| 58 | Model58 | Buy | 67.45% |

| 59 | Model59 | Buy | 62.33% |

| 60 | Model60 | Buy | 58.94% |

| # | Overall | Neutral | -- |

| # | Best | Neutral | 72.75% |

DAXSECTOR INSURANCE TR (CXPIX) predictions list over the past days

| # | Overal Signal | Best Signal | Signals of artificial intelligence models | Stop Loss | |

|---|---|---|---|---|---|

| 1 | 07 Jan | Neutral | Neutral | M30 M54 M55 M56 M58 | ----- |

| 2 | 06 Jan | Neutral | Neutral | M30 M54 M55 M56 M58 | ----- |

| 3 | 05 Jan | Sell | Neutral | M30 M54 M55 M56 M58 | 3070.739990 |

| 4 | 02 Jan | Sell | Neutral | M30 M54 M55 M56 M58 | 3116.969971 |

| 5 | 30 Dec | Sell | Neutral | M30 M54 M55 M56 M58 | 3113.639893 |

| 6 | 29 Dec | Sell | Neutral | M30 M54 M55 M56 M58 | 3114.149902 |

| 7 | 23 Dec | Sell | Neutral | M30 M54 M55 M56 M58 | 3117.030029 |

| 8 | 22 Dec | Buy | Neutral | M30 M54 M55 M56 M58 | 3074.479980 |

| 9 | 19 Dec | Buy | Neutral | M30 M54 M55 M56 M58 | 3062.429932 |

| 10 | 18 Dec | Buy | Neutral | M30 M54 M55 M56 M58 | 3030.590088 |

Users forecasts for DAXSECTOR INSURANCE TR (CXPIX)

What is your prediction?

In this section, you can easily predict without user registration. See also other users predictions.