Free AI-Powered Duroc AB Series B (DURC-B) Trading Signals | Duroc AB Series B (DURC-B) Price Forecast

AI-Powered Duroc AB Series B (DURC-B) Signals and Analysis for Sep 03th

Combining predictions from multiple AI models, each with an accuracy rate of at least 70%, also suggests a sell signal for Duroc AB Series B (DURC-B) on Sep 03. Nevertheless, it is imperative to approach investment decisions with prudence and thorough consideration.

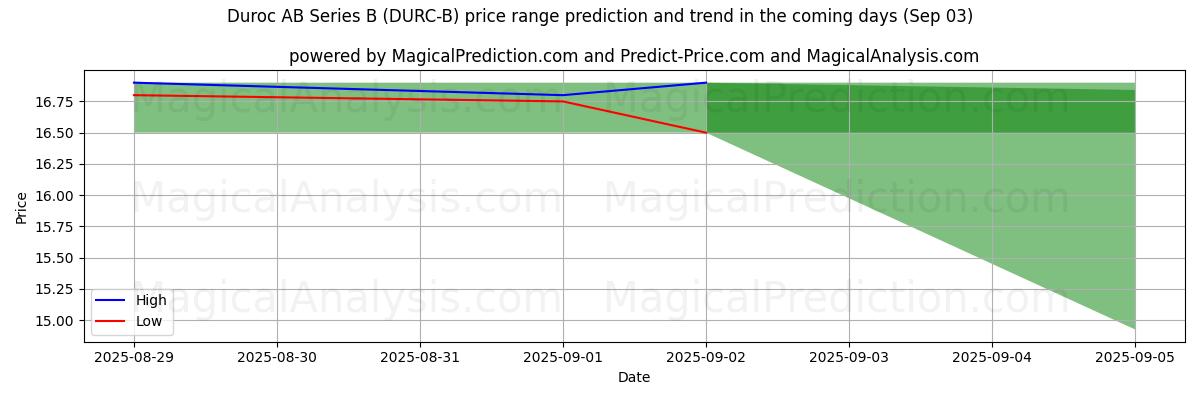

On Sep 03, our AI models forecasted a price range for Duroc AB Series B (DURC-B), estimating a minimum value of 14.925 and a maximum value of 16.9.

Disclaimer! Please exercise caution and perform thorough research before making any financial decisions. Our signals are based solely on daily price changes and do not account for external factors such as news, market sentiment, or company developments. We strongly recommend considering all relevant factors and conducting your own research to make informed decisions.

Useful Tips: For the most informed decisions regarding your Duroc AB Series B (DURC-B) investments, we recommend visiting the "MagicalAnalysis" technical analysis website. They also provide free signals, and if their signals align with ours, it is likely they are reliable, as we have observed over time.

Based on the signals and forecasts above, we recommend the following strategies:

Duroc AB Series B (DURC-B) trading strategy for those holding long positions:

If you are currently in a buy position (long position), it is advisable to choose the optimal time to exit your current position based on the combination of AI models. If you have a high risk tolerance, you may consider waiting for further market movements in the coming days.

Duroc AB Series B (DURC-B) trading strategy for those holding short positions:

If you are currently in a sell position (short position), holding your position may be the most appropriate strategy according to the consensus of our AI models. Nonetheless, remain vigilant and closely monitor market developments.

For new positions:

If you are not currently invested or are considering entering a short position, it is advisable to consider the anticipated price range, which indicates a potential downside of 10.55% based on the lowest expected price. Exercise caution and conduct thorough research to ensure that any new position aligns with your risk tolerance and investment objectives.

It’s important to remember that while AI models offer valuable insights, they are not immune to error, and market conditions can change rapidly. To manage risk, diversify your investment portfolio and consult with a financial advisor.

In summary, AI-based analysis provides valuable tools for navigating the financial markets, but effective decision-making and robust risk management are essential. Stay informed, exercise caution, and regularly reassess your investment strategy to adapt to the ever-evolving market conditions. Your financial future deserves thoughtful and proactive management.

In all your trading activities, implementing a well-defined stop-loss strategy is crucial to managing potential downside risks effectively.

Useful Tips 2: For those interested in long-term forecasts, we suggest utilizing the "predict-price" website, which offers both short-term and long-term predictions for free. This resource can help you make well-informed decisions regarding your Duroc AB Series B (DURC-B) holdings.

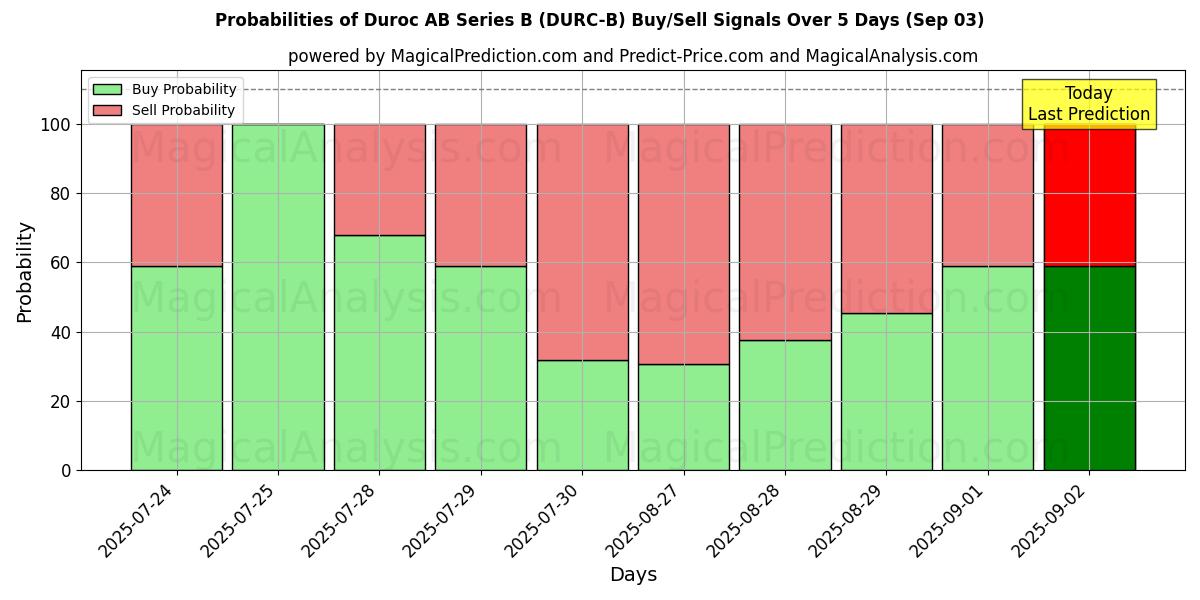

Probabilities of Duroc AB Series B (DURC-B) Buy/Sell Signals Using Several AI Models Over 10 Days (Sep 03)

Duroc AB Series B (DURC-B) AI's overall Signal Chart (03 Sep)

Duroc AB Series B (DURC-B) AI best signal chart (03 Sep)

High and low price prediction by AI for Duroc AB Series B (DURC-B) (03 Sep)

Duroc AB Series B (DURC-B) profit and loss prediction for 03 Sep

Duroc AB Series B (DURC-B) signals list for 03 Sep

| # | AI Model | Last signal | Accuracy |

|---|---|---|---|

| 1 | Model1 | Buy | 60.34% |

| 2 | Model2 | Sell | 97.7% |

| 3 | Model3 | Neutral | 67.03% |

| 4 | Model4 | Sell | 97.7% |

| 5 | Model5 | Buy | 60.29% |

| 6 | Model6 | Sell | 97.7% |

| 7 | Model7 | Neutral | 97.7% |

| 8 | Model8 | Sell | 97.7% |

| 9 | Model9 | Sell | 80.45% |

| 10 | Model10 | Buy | 60.29% |

| 11 | Model11 | Sell | 40.19% |

| 12 | Model12 | Buy | 20.02% |

| 13 | Model13 | Sell | 40.18% |

| 14 | Model14 | Buy | 40.17% |

| 15 | Model15 | Buy | 80.34% |

| 16 | Model16 | Neutral | 33.45% |

| 17 | Model17 | Sell | 40.19% |

| 18 | Model18 | Sell | 80.3% |

| 19 | Model19 | Buy | 80.34% |

| 20 | Model20 | Neutral | 97.7% |

| 21 | Model21 | Sell | 60.18% |

| 22 | Model22 | Buy | 20.07% |

| 23 | Model23 | Neutral | 66.79% |

| 24 | Model24 | Buy | 20.07% |

| 25 | Model25 | Sell | 60.23% |

| 26 | Model26 | Buy | 20.07% |

| 27 | Model27 | Neutral | -- |

| 28 | Model28 | Buy | -- |

| 29 | Model29 | Buy | 40.07% |

| 30 | Model30 | Sell | 60.23% |

| 31 | Model31 | Buy | 80.33% |

| 32 | Model32 | Sell | 97.7% |

| 33 | Model33 | Buy | 80.34% |

| 34 | Model34 | Sell | 80.35% |

| 35 | Model35 | Sell | 40.18% |

| 36 | Model36 | Neutral | 97.7% |

| 37 | Model37 | Buy | 80.33% |

| 38 | Model38 | Buy | 40.22% |

| 39 | Model39 | Sell | 40.18% |

| 40 | Model40 | Neutral | 33.45% |

| 41 | Model41 | Sell | 80.39% |

| 42 | Model42 | Sell | 80.39% |

| 43 | Model43 | Sell | 80.39% |

| 44 | Model44 | Neutral | 67.03% |

| 45 | Model45 | Sell | 75.43% |

| 46 | Model46 | Neutral | 67.03% |

| 47 | Model47 | Neutral | 67.03% |

| 48 | Model48 | Sell | 60.34% |

| 49 | Model49 | Buy | 40.22% |

| 50 | Model50 | Buy | 20.07% |

| 51 | Model51 | Buy | 40.13% |

| 52 | Model52 | Buy | 40.13% |

| 53 | Model53 | Buy | 40.13% |

| 54 | Model54 | Neutral | 66.89% |

| 55 | Model55 | Buy | 50.16% |

| 56 | Model56 | Neutral | 66.89% |

| 57 | Model57 | Neutral | 66.89% |

| 58 | Model58 | Buy | 60.18% |

| 59 | Model59 | Sell | 80.3% |

| 60 | Model60 | Sell | 97.7% |

| # | Overall | Sell | -- |

| # | Best | Sell | 97.7% |

Duroc AB Series B (DURC-B) predictions list over the past days

| # | Overal Signal | Best Signal | Signals of artificial intelligence models | Stop Loss | |

|---|---|---|---|---|---|

| 1 | 02 Sep | Sell | Sell | M2 M3 M4 M6 M7 M8 M9 M15 M18 M19 M20 M23 M31 M32 M33 M34 M36 M37 M41 M42 M43 M44 M45 M46 M47 M54 M56 M57 M59 M60 | 16.900000 |

| 2 | 01 Aug | Buy | Buy | M2 M3 M4 M6 M7 M8 M9 M15 M18 M19 M20 M23 M31 M32 M33 M34 M36 M37 M41 M42 M43 M44 M45 M46 M47 M54 M56 M57 M59 M60 | 16.750000 |

| 3 | 29 Aug | Neutral | Sell | M2 M3 M4 M6 M7 M8 M9 M15 M18 M19 M20 M23 M31 M32 M33 M34 M36 M37 M41 M42 M43 M44 M45 M46 M47 M54 M56 M57 M59 M60 | ----- |

| 4 | 28 Aug | Neutral | Sell | M2 M3 M4 M6 M7 M8 M9 M15 M18 M19 M20 M23 M31 M32 M33 M34 M36 M37 M41 M42 M43 M44 M45 M46 M47 M54 M56 M57 M59 M60 | ----- |

| 5 | 27 Aug | Buy | Buy | M2 M3 M4 M6 M7 M8 M9 M15 M18 M19 M20 M23 M31 M32 M33 M34 M36 M37 M41 M42 M43 M44 M45 M46 M47 M54 M56 M57 M59 M60 | 16.450001 |

| 6 | 30 Jul | Buy | Buy | M2 M3 M4 M6 M7 M8 M9 M15 M18 M19 M20 M23 M31 M32 M33 M34 M36 M37 M41 M42 M43 M44 M45 M46 M47 M54 M56 M57 M59 M60 | 16.500000 |

| 7 | 29 Jul | Buy | Buy | M2 M3 M4 M6 M7 M8 M9 M15 M18 M19 M20 M23 M31 M32 M33 M34 M36 M37 M41 M42 M43 M44 M45 M46 M47 M54 M56 M57 M59 M60 | 16.400000 |

| 8 | 28 Jul | Buy | Buy | M2 M3 M4 M6 M7 M8 M9 M15 M18 M19 M20 M23 M31 M32 M33 M34 M36 M37 M41 M42 M43 M44 M45 M46 M47 M54 M56 M57 M59 M60 | 16.299999 |

| 9 | 25 Jul | Sell | Sell | M2 M3 M4 M6 M7 M8 M9 M15 M18 M19 M20 M23 M31 M32 M33 M34 M36 M37 M41 M42 M43 M44 M45 M46 M47 M54 M56 M57 M59 M60 | 16.950001 |

| 10 | 24 Jul | Buy | Sell | M2 M3 M4 M6 M7 M8 M9 M15 M18 M19 M20 M23 M31 M32 M33 M34 M36 M37 M41 M42 M43 M44 M45 M46 M47 M54 M56 M57 M59 M60 | 16.750000 |

Users forecasts for Duroc AB Series B (DURC-B)

What is your prediction?

In this section, you can easily predict without user registration. See also other users predictions.